Difference between revisions of "Wise"

Jump to navigation

Jump to search

(Add screenshots.) |

|||

| Line 73: | Line 73: | ||

== Alternatives == | == Alternatives == | ||

* There are more [[Germany/Banking|EUR bank accounts]]. | * There are more [[Germany/Banking|EUR bank accounts]]. | ||

| + | |||

| + | == Screenshots == | ||

| + | <gallery mode="traditional" widths=150px heights=300px> | ||

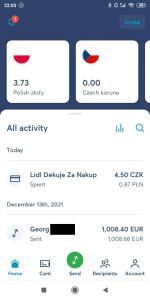

| + | File:Wise.timeline.accounts.jpg|Home: Last transactions with balances by currency | ||

| + | File:Wise.timeline.eur.jpg|Last transactions … | ||

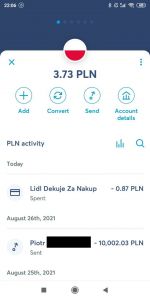

| + | File:Wise.timeline.pln.jpg|… filtered by currency | ||

| + | File:Wise.open.jpg|Open new currency/balance or a jar | ||

| + | File:Wise.stats.jpg|Transactions analysed | ||

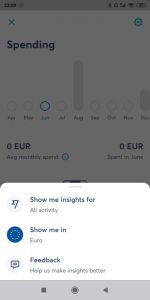

| + | File:Wise.stats.filter.jpg|Filter insights… | ||

| + | File:Wise.stats.filtered.jpg|…filtered view | ||

| + | File:Wise.cards.jpg|Overview of issued cards | ||

| + | File:Wise.cards.limits.jpg|Card limits … | ||

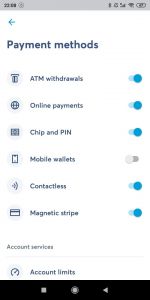

| + | File:Wise.cards.methods.jpg|… & settings | ||

| + | File:Wise.cards.new.jpg|Issue new card | ||

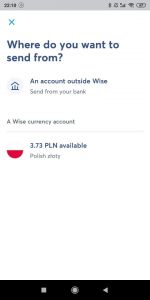

| + | File:Wise.send.source.jpg|Send money | ||

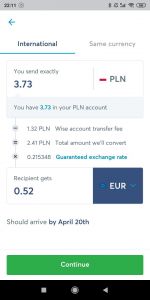

| + | File:Wise.send.international.jpg|International (note: conversion fee is fixed) | ||

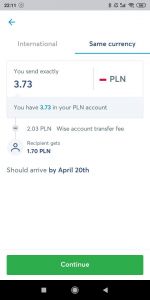

| + | File:Wise.send.national.jpg|National (fee is fixed) | ||

| + | File:Wise.scheduled_transfers.jpg|Scheduled transfers | ||

| + | File:Wise.auto_conversions.jpg|Convert automatically when your desired exchange rate is reached | ||

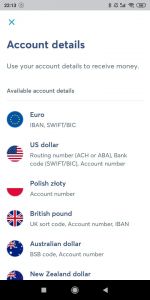

| + | File:Wise.account.jpg|Multiple bank account numbers | ||

| + | File:Wise.recipients.jpg|Choose recipient via contacts | ||

| + | File:Wise.account.receive.jpg|Allow your contacts to find you | ||

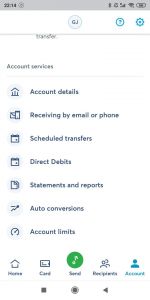

| + | File:Wise.account.settings.jpg|Account settings | ||

| + | </gallery> | ||

== Open a Wise Bank Account == | == Open a Wise Bank Account == | ||

Revision as of 00:31, 20 April 2022

Wise (formerly TransferWise) is finance company from the UK, offering both a service to send & receive money abroad and an online bank account.

The bank account comes with:

- support in 13 languages

- no requirement of a registered address

- no monthly fee for the standard account.

- multiple account numbers for various countries, to send & receive money in different currencies

Frequently Asked Questions (FAQ)

Which documents do I need to open an account?

Wise accepts citizens from all countries. A new customer must provide either a passport, national ID card or driver's license.

How is my money protected?

Wise "keeps your money in accounts separate from the ones they use to run their business." They "deposit your funds at banking institutions and invest them in government backed liquid assets, primarily government bonds." (more info)

How much does Wise cost?

- Opening and keeping the account is free.

- Paying with the Mastercard debit card is free.

- Read more on Wise's pricing.

Which card do I get?

- You can get a Mastercard debit card.

- The card costs a one-time fee of €8.

- You must be a resident in one of these countries.

- After registering a Wise account, you must follow these steps.

What account numbers can I get?

- You can get multiple account numbers.

- You must first add 20 GBP to your account (or the equivalent in your currency).

- You can then get:

- for EUR-SEPA transfers: an IBAN from Belgium 🇧🇪🇪🇺

- for USD transfers: Routing number and Account number from USA 🇺🇸

- for GBP transfers: UK sort code, Account number, and IBAN from the UK 🇬🇧

- for CAD transfers: Institution number, Transit number, and Account number from Canada 🇨🇦

- for AUD transfers: BSB code and Account number from Australia 🇦🇺

- for NZD transfers: Account number from New Zealand 🇳🇿

- for SGD transfers: Bank code, Bank name, and Account number from Singapore 🇸🇬

- for HUF transfers: Account number from Hungary 🇭🇺

- for RON transfers: Bank code (SWIFT/BIC) and Account number from Romania 🇷🇴

- for TRY transfers: Bank name and IBAN from Turkey 🇹🇷

In which languages can I use Wise?

- The app and the customer support are available in:

- English 🇬🇧

- French 🇫🇷

- German 🇩🇪

- Italian 🇮🇹

- Spanish 🇪🇸

- Chinese 🇨🇳🇹🇼

- Hungarian 🇭🇺

- Indonesian 🇮🇩

- Japanese 🇯🇵

- Polish 🇵🇱

- Portuguese 🇵🇹🇧🇷

- Romanian 🇷🇴

- Russian 🇷🇺

- Turkish 🇹🇷

- Customer support is available on their website.

Can I use Wise on my desktop computer?

Yes. You can manage your account both from your smartphone (Android or iOS/Apple) and from your desktop web browser.

Alternatives

- There are more EUR bank accounts.

Screenshots

Open a Wise Bank Account

- ↗️ Click here[1].

- Click on Get an account in minutes.

- Enter your email address.

- Fill out the rest of the form.

- Do the online verification process.

- Top up the account with 20 GBP or EUR to get your account details.

- ↑ Cite error: Invalid

<ref>tag; no text was provided for refs namedaffiliate