Wise

Jump to navigation

Jump to search

Wise[1] (formerly TransferWise) is finance company from the UK, offering both a service to send & receive money abroad and an online bank account. The bank account comes with:

- support in 13 languages

- no requirement of a registered address

- no monthly fee for the standard account.

- multiple account numbers for various countries, to send & receive money in different currencies

Questions & Answers[edit]

Which documents do I need to open an account? [edit]

Wise accepts citizens from all countries.[2] A new customer must provide either a passport, national ID card or driver's license.

How is my money protected? [edit]

Wise "keeps your money in accounts separate from the ones they use to run their business." They "deposit your funds at banking institutions and invest them in government backed liquid assets, primarily government bonds." [3]

How much does Wise cost? [edit]

- Opening and keeping the account is free.

- However a fee of 0.07% applies if you

- hold EUR, and

- hold more than €3000.[4]

- Keeping lower amounts, or in other currencies is free.

- Paying with the Mastercard debit card is free.

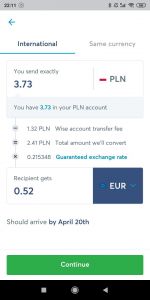

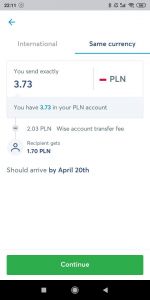

- Sending money to other bank accounts always costs a small, fixed fee (~€0.50).

- Read more on Wise's pricing.

Which card do I get? [edit]

- You can get a Mastercard debit card.

- The card costs a one-time fee of £5 or €8.[5]

- You must be a resident in one of these countries.

- After registering a Wise account, you must follow these steps.

What account numbers can I get? [edit]

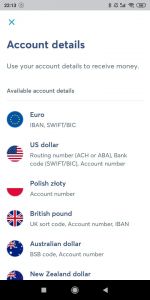

- You can get multiple account numbers.

- You must first add 20 GBP to your account (or the equivalent in your currency).[6]

- You can then get:[7]

- for EUR-SEPA transfers: an IBAN from Belgium 🇧🇪🇪🇺

- for USD transfers: Routing number and Account number from USA 🇺🇸

- for GBP transfers: UK sort code, Account number, and IBAN from the UK 🇬🇧

- for CAD transfers: Institution number, Transit number, and Account number from Canada 🇨🇦

- for AUD transfers: BSB code and Account number from Australia 🇦🇺

- for NZD transfers: Account number from New Zealand 🇳🇿

- for SGD transfers: Bank code, Bank name, and Account number from Singapore 🇸🇬

- for HUF transfers: Account number from Hungary 🇭🇺

- for RON transfers: Bank code (SWIFT/BIC) and Account number from Romania 🇷🇴

- for TRY transfers: Bank name and IBAN from Turkey 🇹🇷

In which languages can I use Wise? [edit]

- The app and the customer support are available in:

- English 🇬🇧

- French 🇫🇷

- German 🇩🇪

- Italian 🇮🇹

- Spanish 🇪🇸

- Chinese 🇨🇳🇹🇼

- Hungarian 🇭🇺

- Indonesian 🇮🇩

- Japanese 🇯🇵

- Polish 🇵🇱

- Portuguese 🇵🇹🇧🇷

- Romanian 🇷🇴

- Russian 🇷🇺

- Turkish 🇹🇷

- Customer support is available on their website.

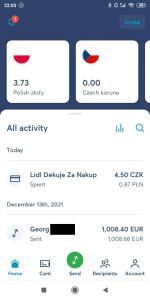

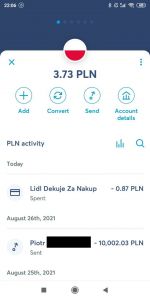

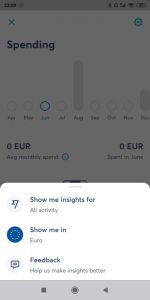

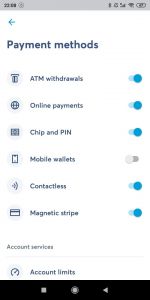

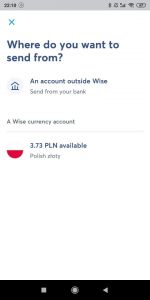

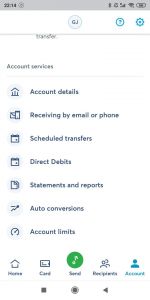

Screenshots[edit]

Alternatives[edit]

- There are more EUR bank accounts.

Open a Wise Bank Account[edit]

- Click here[1].

- Click on Get an account in minutes.

- Enter your email address.

- Fill out the rest of the form.

- Do the online verification process.

Notes[edit]

- ↑ 1.0 1.1 This is an affiliate link. If you click on it and then buy something or sign up for a service, we may earn a commission which covers our expenses. This does not change the price for you.

- ↑ "In this article, we’ll let you know what kinds of ID we accept around the world, as well as what to do if you have refugee status." – source, retrieved 2022-05-01

- ↑ "In keeping with FCA regulations, Wise uses two approaches to safeguard your funds. We deposit your funds at banking institutions and invest them in government backed liquid assets, primarily government bonds." – source, retrieved 2022-05-01

- ↑ "If you’d like to keep more than 3,000 EUR in your Wise account, we’ll charge a 0.07% fee monthly" – source, retrieved 2022-05-01

- ↑ "Order a Wise debit card: 5 GBP" – source, retrieved 2022-05-01

- ↑ "add 20 GBP to your account (or the equivalent in your currency)" – source, retrieved 2022-05-01

- ↑ "These are the account details you can share with others to receive money." – source, retrieved 2022-05-01